How to import sandpaper from China to India?

Importing sandpaper from China to India feels like a maze of rules and costs? Stop letting the uncertainty hold you back. I can show you the way.

Importing sandpaper from China to India involves finding a reliable supplier, understanding India’s customs rules, paying correct duties, and managing shipping logistics.

As someone who has worked with buyers like you for 15 years, I know your concerns. You want quality products at good prices without import headaches. Let’s break down the process.

How to import product from China to India?

Bringing products from China to India seems difficult, slow, and risky? Don’t let these fears stop you from getting the products you need. It is possible with the right steps.

To import products from China into India, you need an Import-Export Code (IEC), must find a trusted supplier, handle contracts, manage shipping, and clear goods through Indian Customs.

My experience with buyers from India shows me you need clear steps. It is like building something; you need a plan. Here is the plan for importing from China.

Steps to Get Your Products to India

First, you must get an Import-Export Code (IEC) from the Directorate General of Foreign Trade (DGFT) in India. You cannot import commercially without it. This is your basic license. Then, you find your supplier in China. This is key. You need a supplier who understands your needs for quality sandpaper and can handle the export side correctly. We have 15 years doing this. We know how to prepare shipments for markets like India. We have sent our abrasives to customers in many countries.

Next, you make a contract or Purchase Order with the supplier. This should clearly state the products, quantity, price, payment terms, and shipping terms (like FOB or CIF). FOB means we get the goods onto the ship in China, and you handle the rest. CIF means we pay for shipping and insurance to your port in India. Many buyers prefer FOB.

After we produce your order, we get it ready for export. We prepare all necessary documents like the Commercial Invoice, Packing List, and Bill of Lading. These papers are very important for customs clearance in India. You hire a freight forwarder and a customs broker in India. The freight forwarder handles getting the goods from the China port to the India port. The customs broker handles clearing the goods through Indian Customs. They need the documents we provide. They will also help you pay the correct import duties and taxes. Once customs clears the goods, you arrange transport from the India port to your warehouse. This whole process needs good communication between you, us, your freight forwarder, and your customs broker. I make sure our documents are always accurate to help speed up your process.

Here are the main steps:

| Step | Who Does It? (Example: FOB) | Key Action |

|---|---|---|

| Get IEC | Importer (You) | Apply to DGFT in India. |

| Find Supplier | Importer (You) | Choose experienced China exporter (like us!). |

| Place Order | Importer (You) | Agree on price, quantity, terms. |

| Production | Supplier (Us) | Make products, ensure quality. |

| China Export | Supplier (Us) | Prepare documents, get goods to port. |

| Ocean Freight | Importer (You) / Forwarder | Book ship, transport goods across ocean. |

| India Customs | Importer (You) / Broker | File Bill of Entry, pay duties, get clearance. |

| Inland Transport India | Importer (You) | Get goods from port to your location. |

It is important to plan each step. My experience is that good planning makes the import process much smoother and faster.

How much is import duty from China to India?

Worried about import duties making your sandpaper too expensive in India? Does figuring out taxes feel like solving a complex puzzle? Let’s make the costs clear.

The import duty amount from China to India depends on the product type (HSN code), its value, Basic Customs Duty (BCD) rates, and Integrated Goods and Services Tax (IGST).

Many buyers from India ask me about duty costs. They need to know the final cost to price their products correctly. I tell them it is not one simple number, but you can calculate it.

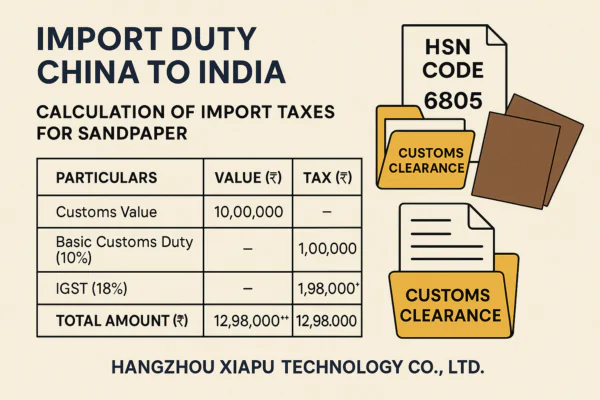

Calculating Your Import Tax Bill in India

In India, import taxes have a few parts. The main tax is called Basic Customs Duty (BCD). The rate for BCD depends on the product’s HSN code (Harmonized System of Nomenclature), which is like the HTS code used in other countries. Sandpaper has specific HSN codes. You must find the correct HSN code for the specific type of sandpaper you are importing. The BCD rate is a percentage of the assessed value of the goods. The assessed value is usually close to the price you paid on the commercial invoice.

On top of the BCD, you must also pay Integrated Goods and Services Tax (IGST). IGST is charged on the value of the goods plus the BCD amount. The IGST rate for most products, including abrasives, is usually 18%. Sometimes, there might be other small taxes or fees too, but BCD and IGST are the biggest costs. Also, India can put anti-dumping duties or safeguard duties on specific products from certain countries, including China, if they think those imports are harming Indian industries. You need to check if any such duties apply to your specific sandpaper HSN code. My experience is that standard sandpaper often does not have these extra duties, but it is always best to check the current rules.

You calculate the total tax roughly like this:

- Calculate BCD: (Assessed Value) * (BCD Rate %)

- Calculate IGST: (Assessed Value + BCD Amount) * (IGST Rate %)

- Total Tax = BCD Amount + IGST Amount + any other fees.

Your customs broker in India will do the exact calculation. They need the commercial invoice and Bill of Entry. They make sure you pay the correct amount to avoid problems. Getting the HSN code right is the first step to knowing the BCD rate. We provide the correct HSN codes for our sandpaper products based on international standards.

Here is what affects your tax amount:

| Factor | How It Affects Tax | Example (Sandpaper) |

|---|---|---|

| HSN Code | Determines Basic Customs Duty (BCD) percentage. | Specific code for "abrasive paper or paperboard." |

| Assessed Value | The value Indian Customs taxes goods on. | Based on your commercial invoice value. |

| BCD Rate | The base customs percentage from HSN. | A specific percentage (e.g., 10%). |

| IGST Rate | The Goods and Services Tax percentage (usually 18%). | Applied to Value + BCD. |

| Other Duties | Can include anti-dumping or safeguard duties. | Check if any apply to your specific HSN. |

You should get an estimate from your customs broker based on the HSN code and value before the shipment arrives. This helps you budget and confirm profitability.

Can we ship products from China to India?

Are you unsure if shipping goods from China to India is even possible right now due to past issues or news? It is important to know if the path is open for your business.

Yes, you can ship products commercially from China to India. Trade continues between the two countries, although importers should stay aware of potential policy changes or increased scrutiny on certain goods.

Sometimes, news headlines create questions about trade between China and India. My clients in India sometimes ask if they can still receive shipments from us. My answer is yes, trade flows.

The Reality of China-India Shipping

Commercial shipping routes between China and India are active. Vessels regularly move goods between ports like Shanghai, Ningbo, or Qingdao in China and ports like Nhava Sheva (Mumbai), Chennai, or Mundra in India. My experience over 15 years shows a continuous movement of goods, including our abrasive products. We ship containers of sandpaper and sanding cloth to India regularly.

While official trade is allowed, there can be challenges. Sometimes, shipments might face increased checks at Indian ports. This can happen without warning and can cause delays. This is usually linked to government policies or security checks. However, if your documentation is perfect, and your products meet all Indian standards and regulations, these checks usually pass eventually. It is very important that the supplier (us) provides accurate and complete paperwork. Incorrect papers cause delays and problems. I always make sure our export team checks every document carefully for Indian shipments.

You might also hear about calls in India to reduce dependence on China or promote ‘Make in India’. This is true and is a factor. However, for many products like high-performance sandpaper, finding the same quality and price point locally can be difficult. Our products offer quality comparable to international brands but at a price point that gives Indian buyers a good margin. This value proposition keeps the demand for importing certain goods from China strong. So, while the political background exists, the actual commercial shipping and importing process is ongoing.

Here is a look at the shipping reality:

| Aspect | Status/Description | Importer’s Action |

|---|---|---|

| Sea Routes | Active and operational. | Work with reliable freight forwarder. |

| Customs Checks | Possible increased scrutiny at times. | Ensure perfect documentation from supplier. |

| Government Policy | Focus on local production exists. | Understand your product’s market position/value. |

| Product Standards | Goods must meet BIS (Bureau of Indian Standards) etc. | Confirm supplier compliance (we meet high standards). |

| Logistics | Requires coordination (supplier, forwarder, broker). | Stay in communication with all parties. |

In summary, you can ship products from China to India. It needs careful planning, correct documentation, and working with experienced partners like us and a good customs broker in India.

Is import from China allowed in India?

Still unsure if importing goods from China is currently permitted by the Indian government? You need certainty that your business plan is legal and viable. Let’s confirm the legal status.

Yes, commercial import of goods from China is generally allowed in India, though specific products might require licenses or face restrictions based on government policy and trade agreements.

Based on my daily work with international buyers, I know this question comes up often, especially with India. Buyers need to know the rules are stable for their business. India’s government sets the rules.

The Legal Basis for Importing from China to India

India allows importing most goods from China under its foreign trade policy. You need the basic Import-Export Code (IEC) we talked about earlier. This code confirms you are registered to import. Many products can be imported freely without a specific import license. This includes standard industrial goods like sandpaper. You just follow the normal customs procedures.

However, the Indian government can restrict or prohibit the import of certain goods. This is usually done for specific reasons like protecting domestic industries, national security, or public health. They announce these restrictions through official notifications from the DGFT or customs. For example, some electronic goods or specific raw materials might face restrictions. For standard sandpaper and abrasive products, generally, there are no such restrictions. We export these freely from China, and our Indian clients import them successfully.

It is important for you, as the importer, to stay updated on India’s import policy. You can check the DGFT website or work closely with your customs broker in India. They are experts on the current rules and any changes. My experience over 15 years shows that while policies can shift slightly, the main flow of goods like abrasives between China and India has remained permitted. We comply with all China export regulations, and our products meet international quality standards which helps with smooth import into India.

Here is how to think about the legal status:

| Aspect | Explanation | How It Applies to Sandpaper |

|---|---|---|

| General Policy | Most goods allowed under Foreign Trade Policy. | Sandpaper is generally allowed. |

| Import License | Needed for specific restricted items only. | Usually not needed for standard sandpaper. |

| IEC Code | Mandatory registration for all importers. | Required for you, the Indian buyer. |

| Specific Bans | Can be placed on certain goods or origins. | No general ban on standard sandpaper from China. |

| Policy Changes | Government can change rules over time. | Stay informed via DGFT, customs broker. |

So, yes, importing sandpaper from China to India is allowed. You just need the right registration (IEC) and must follow the standard customs process and pay the required duties.

Conclusion

Importing sandpaper from China to India is allowed. Follow the steps, get your IEC, work with good partners, and understand the duties based on HSN code and value.

You may also be interested in:

What is the difference between zirconium, ceramic, and aluminum oxide abrasives?

Choosing the right abrasive can be confusing. Using the wrong one wastes time, ruins your workpiece, and costs you money. Let’s make the choice simple for you. The main difference

Best Sandpaper for Aluminum: NOVOGRIT's Guide to Flawless Finishes

What is the Best Type of Sandpaper to Use on Aluminum? Do you find yourself frustrated by sandpaper that gums up instantly when you try to smooth aluminum? It is

Best Sandpaper for Paint Removal: Grits, Types, & Tips | NOVOGRIT

What is the Best Sandpaper for Removing Paint? Are you tired of staring at chipped, peeling paint on your furniture, walls, or even your car? It's a common problem, and

Automotive Wet Sanding: Supplies, Liquids & Best Sandpaper

Automotive Wet Sanding Supplies: What Do You Really Need? Wet sanding is a crucial technique in automotive refinishing, used to achieve a flawlessly smooth surface before painting or polishing. Unlike

Best Sandpaper for Paint Removal & Grit Guide

What Is the Best Sandpaper for Removing Paint? Removing old paint can be a tedious job, but using the right sandpaper makes all the difference. It's not just about grit;

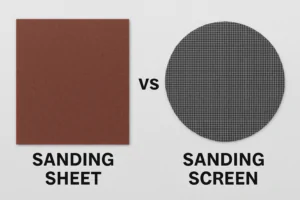

Hardwood Floor Sanding: Screen vs. Sandpaper & Best Practices

Sanding Screen vs. Sandpaper for Hardwood Floors: Which is Best? When you're tackling hardwood floor projects, choosing the right abrasive is crucial for achieving a smooth, professional finish. Both sanding

Paper Backing vs. Mesh Sanding Discs: Which Abrasive to Choose?

Paper Back vs. Mesh Sanding Discs: Which One Should You Pick? Choosing the right sanding disc backing can significantly impact your project's efficiency and finish quality. Paper-backed discs are a

Sanding Mesh vs Paper: Which is More Economical and Better?

Is Sanding Mesh More Economical Than Sandpaper? Comparing Abrasive Costs When stocking up on abrasives, cost is always a factor. Paper sandpaper has traditionally been the standard, but newer mesh

Sanding Nets & Screens Use Cases: When to Choose Mesh Abrasives

Sanding Nets and Screens: What Are Their Best Use Cases? When you encounter sanding nets or screens, you might wonder where they fit into your sanding projects. Unlike traditional solid-backed