Importing Sandpaper from China to Brazil: How Can You Do It Effectively?

Buying sandpaper from China feels risky? Worried about quality, costs, or customs headaches? It’s a common pain point.

**Importing sandpaper from China to Brazil involves finding a trusted supplier, managing shipping logistics, navigating Brazilian customs procedures, and paying import taxes. You need a clear plan for each step.

I understand the challenges. As a manufacturer with 15 years in the abrasive business, I have seen many clients successfully import our products to Brazil. Let me break down the process for you.

How can I import directly from China?

Thinking about buying directly from a Chinese factory? The idea of better prices and more control is tempting.

You can import directly from China by registering as an importer in Brazil (getting a RADAR license), finding a reliable supplier, agreeing on terms, handling logistics, and clearing customs. It takes careful planning.

Importing direct gives you power. You cut out middlemen. This can mean higher profit margins for you. But it adds responsibility too. From my experience working with buyers like you, the first step is often the biggest hurdle: trusting the factory you choose. You need a partner who understands your needs. We build that trust over time.

Why Choose Direct Import?

Direct import is not for everyone. It requires more effort from you. But the rewards can be big.

- Cost Savings: You buy at factory price, not distributor price.

- Control: You control product specifications and quality checks.

- Relationship: You build a direct relationship with the manufacturer. This helps with custom orders.

What You Need for Direct Import

Brazil has specific rules for importers. You must follow them strictly.

- RADAR License: This is your key to import. You get it from the Brazilian Federal Revenue (Receita Federal).

- Supplier Verification: You must check the factory’s ability. Look at their production lines and quality control.

-

Contract: A clear contract protects both sides. It should cover product specs, price, payment terms, and delivery terms (Incoterms).

Here is a simple comparison of direct import versus using a local agent:Feature Direct Import Using a Local Agent Cost Generally lower per unit Includes agent’s margin Control High control over quality and process Agent handles details, less direct control Complexity High, you manage logistics and customs Lower, agent manages logistics and customs Relationship Direct with factory Primary relationship is with the agent Ideal for High volume buyers, want custom products Lower volume buyers, less import experience At our factory, we work directly with large buyers like you. We understand your high demands for quality and service. We have 15 years of experience exporting. We make it easier for you to import direct. We provide all necessary documents and support. We help manage the process from our side. One time, I saw a buyer struggle with paperwork from another factory. When they came to us, we streamlined everything. It saved them weeks of delay.

How to import sandpaper from China to Brazil?

The step-by-step process can look scary at first glance. But it breaks down into manageable parts.

**Importing sandpaper involves identifying needs, finding a qualified supplier, placing an order, arranging shipping and insurance, handling customs clearance in Brazil, and finally receiving your goods.

Each step has its own details.

This is not a simple online purchase. You are dealing with international trade. It requires planning and attention to detail. From my perspective as a supplier, I see where importers face problems. Often, issues happen when communication breaks down or when steps are missed. A good supplier helps you avoid these traps. We see ourselves as part of your supply chain.Key Stages in the Import Process

Successfully getting sandpaper from my factory to your warehouse in Brazil follows a path.

- Planning & Sourcing: Define what sandpaper you need (type, grit, size). Find reliable suppliers.

- Ordering: Agree on terms (price, payment, Incoterms). Place your purchase order.

- Production: The factory makes your order. Quality control happens here.

- Logistics: Goods are packed, transported to port, and shipped. This involves freight forwarders.

- Customs Clearance (China): Export declaration is made in China.

- Shipping: Goods travel by sea or air.

- Customs Clearance (Brazil): Import declaration is made. Taxes and duties are paid. Goods are inspected.

-

Delivery: Goods are transported from the port to your final destination.

Here is a summary of the key stages:Stage Description Your Role Supplier’s Role Sourcing Finding manufacturers Research, evaluation, contact Provide information, samples Ordering Finalizing details, placing PO Negotiate terms, issue PO Confirm order, prepare contract Production Manufacturing the goods Monitor progress (optional) Produce according to specs, QC Logistics Prep Arranging transport from factory to port Provide shipping info (forwarder) Arrange internal transport, packing Export Prep Handling China export documentation Provide required documents (rarely) Handle export clearance documentation Shipping Transporting goods by sea/air Coordinate with forwarder Load goods onto vessel/plane Import Prep Preparing documents for Brazil customs Provide import docs (Invoice, PL, BL) Provide commercial invoice, packing list, BL Customs Brazil Clearing goods through Brazilian customs File import declaration, pay duties Support with document questions Delivery Transporting goods to final warehouse Arrange final transport (Usually ends at Brazilian port) My team understands the documentation needed for Brazil. We make sure the commercial invoice and packing list are perfect. An error here can cause long delays and extra costs. I have seen shipments held up for weeks because of small mistakes in paperwork. We double-check everything before shipping. We want your importing process to be smooth. Our quality goes beyond the product; it includes the entire transaction.

How much does it cost to ship a container from China to Brazil?

Shipping cost is a big part of your total import expense. It can change a lot based on market conditions and shipping method.

**Shipping a container from China to Brazil involves freight charges, origin charges (in China), ocean freight, destination charges (in Brazil), and potentially insurance. Costs vary based on container size, shipping lines, route, and current market rates.

Understanding shipping costs is key to accurate pricing for your final product. Ocean freight is usually the most cost-effective for bulk items like sandpaper. Air freight is much faster but much more expensive. For a typical container of sandpaper, ocean freight is almost always the choice. We often work with freight forwarders who specialize in the China-Brazil route. They can get competitive rates.Key Components of Shipping Cost

The price is not just the amount the shipping line charges to move the box across the ocean. Many fees are involved.

- Origin Charges (China): Costs at the export port (e.g., terminal handling, documentation, trucking from factory).

- Ocean Freight: The main cost for transport across the sea. This fluctuates wildly based on global demand, fuel prices, and vessel availability.

- Insurance: Protects your goods during transit against loss or damage. It is highly recommended.

- Destination Charges (Brazil): Costs at the import port (e.g., terminal handling, unloading, inspection fees).

-

Inland Transportation (Brazil): Getting the container from the port to your warehouse.

Here is a breakdown of typical costs involved when shipping a container:Cost Category Description Paid In Varies By Origin Charges Loading, documentation, transport to port in China China (usually USD) Port, forwarder, service level Ocean Freight Main transport from China port to Brazil port China (usually USD) Shipping line, route, season, fuel costs Insurance Coverage against loss/damage during transit Varies Value of goods, insurance provider Destination Charges Unloading, terminal handling, local fees in Brazil Brazil (usually BRL) Port, forwarder, local regulations Inland Transport Port to your final warehouse in Brazil Brazil (usually BRL) Distance, transport company, road conditions We usually provide terms like FOB (Free On Board) or CIF (Cost, Insurance, Freight). With FOB, our responsibility ends when goods are loaded onto the ship in China. You handle the rest. With CIF, we cover freight and insurance to the Brazilian port. You need to understand Incoterms. They define who pays for what and when responsibility transfers. From my experience, CIF seems simpler for buyers sometimes, but FOB gives you more control over shipping costs by choosing your own forwarder. We work with your preferred Incoterms. We ensure the goods are ready for loading and provide accurate shipping details.

How much is the import tax to Brazil?

Brazilian import taxes can be high and complex. Knowing the costs upfront is essential for pricing your products.

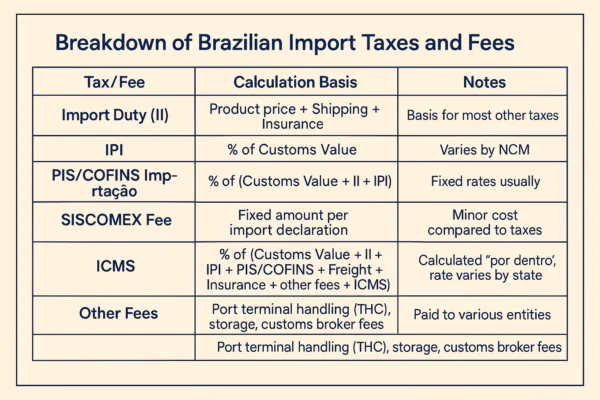

Import taxes in Brazil include Import Duty (II), Industrialized Products Tax (IPI), Social Contributions (PIS/COFINS), and State VAT (ICMS), calculated based on the product’s NCM code and value, plus other fees. The total can significantly increase the landed cost.

This is often the most confusing part for importers. Brazil has a complex tax system. The NCM (Nomenclatura Comum do Mercosul) code for your sandpaper is the key. This code determines the specific tax rates (II, IPI, PIS/COFINS). ICMS is a state tax, so its rate varies depending on the Brazilian state where you import the goods. You also have port fees and other charges from customs brokers. Getting this wrong means unexpected costs or delays. We provide accurate NCM codes and product descriptions on the invoice to help your customs broker.Breakdown of Brazilian Import Taxes and Fees

Understanding each component helps you estimate the final cost.

- Import Duty (Imposto de Importação – II): Applied to the customs value of the goods. Rates vary widely by NCM code.

- Industrialized Products Tax (Imposto sobre Produtos Industrializados – IPI): Applied after the II is added to the customs value. Rates depend on the product (NCM).

- Social Contributions (PIS/COFINS – Importação): Federal taxes applied to the customs value plus the II and IPI.

- State VAT (Imposto sobre Circulação de Mercadorias e Serviços – ICMS): Applied by the destination state. The tax base includes the customs value, II, IPI, PIS/COFINS, freight, insurance, and even the ICMS itself (calculated "por dentro").

-

SISCOMEX Fees: Fees for using the Brazilian Integrated Foreign Trade System.

Here is an example structure of how Brazilian import taxes are calculated:Tax/Fee Calculation Basis Notes Customs Value Product price + Shipping + Insurance Basis for most other taxes Import Duty (II) % of Customs Value Varies by NCM IPI % of (Customs Value + II) Varies by NCM PIS/COFINS Importação % of (Customs Value + II + IPI) Fixed rates usually SISCOMEX Fee Fixed amount per import declaration Minor cost compared to taxes ICMS % of (Customs Value + II + IPI + PIS/COFINS + Freight + Insurance + other fees + ICMS itself) Calculated "por dentro", rate varies by state Other Fees Port terminal handling (THC), storage, customs broker fees Paid to various entities You must work with a good customs broker in Brazil. They navigate the system and calculate the exact taxes. We provide them with all the necessary documents: commercial invoice, packing list, Bill of Lading, and sometimes certificates of origin if required for trade agreements that might lower the II rate. Make sure the NCM code on our invoice matches what your broker uses. I have seen situations where a wrong NCM code led to incorrect tax calculations and significant delays. We double-check this for our clients shipping to Brazil. We want to help your goods clear customs fast.

Conclusion

Importing sandpaper from China to Brazil has steps. Find a good supplier like us. Manage shipping and customs carefully.

Translated with DeepL.com (free version)

You may also be interested in:

What is the difference between zirconium, ceramic, and aluminum oxide abrasives?

Choosing the right abrasive can be confusing. Using the wrong one wastes time, ruins your workpiece, and costs you money. Let’s make the choice simple for you. The main difference

Best Sandpaper for Aluminum: NOVOGRIT's Guide to Flawless Finishes

What is the Best Type of Sandpaper to Use on Aluminum? Do you find yourself frustrated by sandpaper that gums up instantly when you try to smooth aluminum? It is

Best Sandpaper for Paint Removal: Grits, Types, & Tips | NOVOGRIT

What is the Best Sandpaper for Removing Paint? Are you tired of staring at chipped, peeling paint on your furniture, walls, or even your car? It's a common problem, and

Automotive Wet Sanding: Supplies, Liquids & Best Sandpaper

Automotive Wet Sanding Supplies: What Do You Really Need? Wet sanding is a crucial technique in automotive refinishing, used to achieve a flawlessly smooth surface before painting or polishing. Unlike

Best Sandpaper for Paint Removal & Grit Guide

What Is the Best Sandpaper for Removing Paint? Removing old paint can be a tedious job, but using the right sandpaper makes all the difference. It's not just about grit;

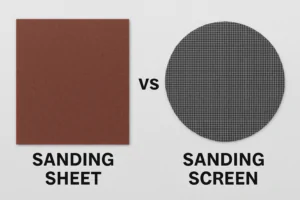

Hardwood Floor Sanding: Screen vs. Sandpaper & Best Practices

Sanding Screen vs. Sandpaper for Hardwood Floors: Which is Best? When you're tackling hardwood floor projects, choosing the right abrasive is crucial for achieving a smooth, professional finish. Both sanding

Paper Backing vs. Mesh Sanding Discs: Which Abrasive to Choose?

Paper Back vs. Mesh Sanding Discs: Which One Should You Pick? Choosing the right sanding disc backing can significantly impact your project's efficiency and finish quality. Paper-backed discs are a

Sanding Mesh vs Paper: Which is More Economical and Better?

Is Sanding Mesh More Economical Than Sandpaper? Comparing Abrasive Costs When stocking up on abrasives, cost is always a factor. Paper sandpaper has traditionally been the standard, but newer mesh

Sanding Nets & Screens Use Cases: When to Choose Mesh Abrasives

Sanding Nets and Screens: What Are Their Best Use Cases? When you encounter sanding nets or screens, you might wonder where they fit into your sanding projects. Unlike traditional solid-backed