How to import sandpaper from China to USA?

Importing goods feels complex, scary, and full of hidden costs? Stop worrying about the hassle. I can help you understand the process.

Importing sandpaper from China to the USA requires knowing US Customs rules, getting necessary documents, calculating costs like tariffs, and working with reliable partners like us to manage logistics.

I know you need clear steps and answers to your questions. Let’s break down how importing works, what taxes apply, and how much you might pay.

How to import product from China to USA?

Bringing products from China to the US seems hard, stressful, and risky? Don’t let fear stop you. You can do this the right way.

To import products from China to the USA, you must find a trusted supplier, agree on terms, handle shipping and customs clearance, and understand all fees.

Based on my 15 years helping businesses get abrasive products, I know the steps. Importing does not have to be a mystery. You just need the right guide.

Key Steps to Importing Success

First, you find a supplier. This step is very important. A good supplier makes everything easier. I have seen many problems happen because someone picked the wrong partner. You need a company with experience in export to the US. They should understand your needs for quality and price. Look at their factory, their history, and their quality control. We have 15 years doing this. We know how US buyers work. We have our own R&D and production lines. This means we control quality from start to finish.

After finding your supplier, you agree on terms. This includes price, quantity, payment terms (like T/T or L/C), and shipping terms (like FOB, CIF, EXW). FOB (Free On Board) means the supplier pays to get the goods to the ship in China. You pay for shipping from there. CIF (Cost, Insurance, Freight) means the supplier pays for shipping and insurance to your port. Most buyers use FOB or EXW (Ex Works), where you handle everything from our factory.

Once terms are set, we produce your order. Our factory has advanced machines and high capacity. We make sure the quality is correct before shipping. Then we arrange transport. This involves trucking to the port, ocean freight across the Pacific, and then getting the goods through US Customs. You often need a customs broker in the US. They help with paperwork and taxes.

This table shows key points:

| Step | Who Does It? (Example: FOB) | Important Point |

|---|---|---|

| Find Supplier | Importer (You) | Choose experienced company (like us!). |

| Place Order | Importer (You) | Agree on price, quantity, terms. |

| Production | Supplier (Us) | Quality control is key. |

| Local Transport | Supplier (Us) | Get goods to port. |

| Ocean Freight | Importer (You) | Book ship, pay carrier. |

| Customs Clearance | Importer (You) / Broker | Handle paperwork, pay duties/fees. |

| Inland Transport US | Importer (You) | Get goods from port to your warehouse. |

Remember, communication with your supplier and customs broker is very important throughout this process. We provide all needed documents for customs.

Do I have to pay import tax from China to US?

Worried about unexpected costs adding up fast when importing? It feels like a confusing maze of fees? Let’s clear things up now.

Yes, you absolutely have to pay import tax, also known as duties or tariffs, when bringing most goods from China into the United States.

Many buyers ask me about this. They worry about high costs. I tell them: Yes, you pay tax. But you can understand it. Knowing this helps you plan your costs correctly.

Understanding US Import Duties and Tariffs

The US government charges taxes on imported goods. These taxes are called duties or tariffs. The rate of tax depends on several things. The main thing is the type of product you import. Every product has a code called an HTS code (Harmonized Tariff Schedule). This code tells customs what the product is. It also tells them the general tax rate.

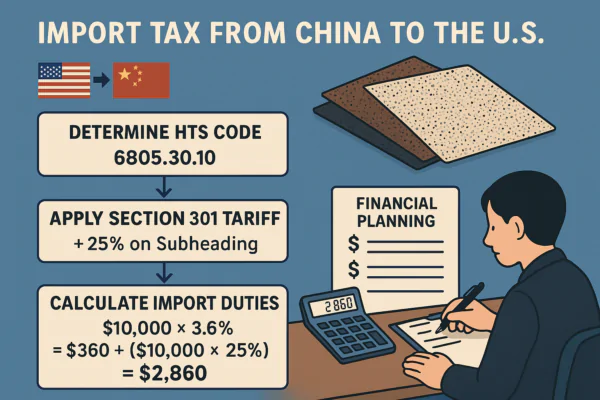

For goods from China, there is an extra layer. The US put special tariffs on many products from China under Section 301. This is because of trade issues between the two countries. Sandpaper and abrasive products are on these lists. This means you pay the regular HTS duty rate plus the Section 301 tariff rate. This makes importing from China more expensive than it used to be.

You must pay these taxes before US Customs will release your goods. A customs broker usually handles this payment for you. They make sure the correct codes and values are used. Paying the wrong amount or using wrong information can cause delays and fines. I always make sure our export documents are perfect. This helps your broker clear customs smoothly.

Here is what affects if you pay tax:

| Factor | Explanation | Relevance to Payment |

|---|---|---|

| Product Type | Defined by HTS Code. | Determines base duty rate. |

| Country of Origin | Where product was made (China). | Triggers Section 301 tariffs. |

| Value of Goods | Commercial Invoice value. | Tax is calculated on this value. |

| Buyer Status | Commercial import. | Tax applies unlike small gifts. |

So, plan for these costs. They are a normal part of importing from China now. Knowing this helps you set your final product price in the US market correctly.

How much tax will I pay if I import from China?

Figuring out the exact tax amount feels confusing, like a guessing game? You need a clear number to plan your business? Let’s look at how it’s calculated.

The amount of tax you pay when importing from China depends on the product’s type (HTS code), its declared value, and current special tariffs like the Section 301 duties.

Clients often ask me: "What will customs charge me?" I cannot give an exact dollar amount without details. But I can explain how you figure it out. It involves specific information about your shipment.

Calculating Your Import Tax

The tax amount is based on the "customs value" of your shipment. Usually, this is the price you paid for the goods (the commercial invoice value). The tax rate is a percentage of this value. This percentage comes from the HTS code for your product. You find the HTS code for sandpaper or sanding discs. This code has a base duty rate.

Then, you add the Section 301 tariff rate. For many goods from China, this rate is 25%. So, your total tax rate is the base HTS rate plus the Section 301 rate. For example, if the base rate is 3% and the Section 301 rate is 25%, your total tax rate is 28%. You pay 28% of the goods’ value as tax. There might be other small fees too, but the duty and tariff are the main costs.

You calculate the tax like this: (Value of Goods) * (Total Duty Rate). A shipment worth $10,000 with a 28% total rate will have $2,800 in import taxes. This tax is paid to US Customs. Your customs broker handles this calculation and payment for you. They need the commercial invoice, packing list, and bill of lading. We provide these documents clearly and correctly. This helps your broker calculate the tax right the first time.

Here are the factors affecting how much you pay:

| Factor | How It Affects Tax | Example (Sandpaper) |

|---|---|---|

| HTS Code | Determines base percentage rate. | Specific code for "sanding discs." |

| Customs Value | The dollar amount tax is calculated on. | Your invoice total. |

| Section 301 Tariff | Adds an extra percentage (often 25%) for China goods. | Increases the final tax rate significantly. |

| Freight/Insurance | Sometimes included in value depending on terms (CIF). | Can slightly increase the tax base. |

Always get a clear HTS code from your supplier and ask your customs broker for an estimate before you ship. This helps you avoid surprises and manage your costs. We can provide the correct HTS codes for our products.

Conclusion

Importing from China is manageable with the right steps. Know the process, expect import taxes, and calculate costs based on product value and tariffs.

You may also be interested in:

What is the difference between zirconium, ceramic, and aluminum oxide abrasives?

Choosing the right abrasive can be confusing. Using the wrong one wastes time, ruins your workpiece, and costs you money. Let’s make the choice simple for you. The main difference

Best Sandpaper for Aluminum: NOVOGRIT's Guide to Flawless Finishes

What is the Best Type of Sandpaper to Use on Aluminum? Do you find yourself frustrated by sandpaper that gums up instantly when you try to smooth aluminum? It is

Best Sandpaper for Paint Removal: Grits, Types, & Tips | NOVOGRIT

What is the Best Sandpaper for Removing Paint? Are you tired of staring at chipped, peeling paint on your furniture, walls, or even your car? It's a common problem, and

Automotive Wet Sanding: Supplies, Liquids & Best Sandpaper

Automotive Wet Sanding Supplies: What Do You Really Need? Wet sanding is a crucial technique in automotive refinishing, used to achieve a flawlessly smooth surface before painting or polishing. Unlike

Best Sandpaper for Paint Removal & Grit Guide

What Is the Best Sandpaper for Removing Paint? Removing old paint can be a tedious job, but using the right sandpaper makes all the difference. It's not just about grit;

Hardwood Floor Sanding: Screen vs. Sandpaper & Best Practices

Sanding Screen vs. Sandpaper for Hardwood Floors: Which is Best? When you're tackling hardwood floor projects, choosing the right abrasive is crucial for achieving a smooth, professional finish. Both sanding

Paper Backing vs. Mesh Sanding Discs: Which Abrasive to Choose?

Paper Back vs. Mesh Sanding Discs: Which One Should You Pick? Choosing the right sanding disc backing can significantly impact your project's efficiency and finish quality. Paper-backed discs are a

Sanding Mesh vs Paper: Which is More Economical and Better?

Is Sanding Mesh More Economical Than Sandpaper? Comparing Abrasive Costs When stocking up on abrasives, cost is always a factor. Paper sandpaper has traditionally been the standard, but newer mesh

Sanding Nets & Screens Use Cases: When to Choose Mesh Abrasives

Sanding Nets and Screens: What Are Their Best Use Cases? When you encounter sanding nets or screens, you might wonder where they fit into your sanding projects. Unlike traditional solid-backed